Turbotax 1040x amendment download#

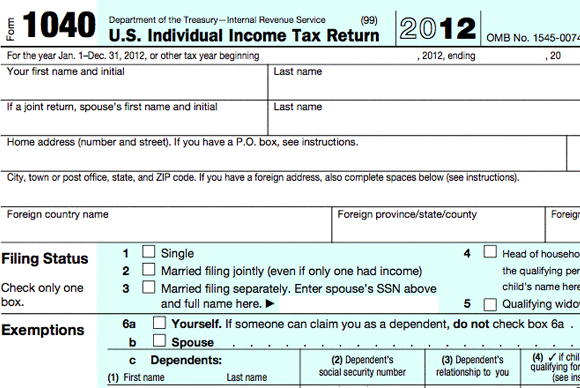

Step 4: Download and prepare new schedules and attachments You can find IRS forms from prior years using TurboTax's prior-year returns function, or you can search through the IRS website for it. This will allow you to recalculate your tax and to see which numbers on the original tax return will change as a result of the amendment. If you are correcting an error on your original tax return, you will need a blank copy of that particular form from the same year. Step 3: Identify the error or amendment you wish to make You can easily find it using the search function on the TurboTax website. This is the only form you can use to amend a personal tax return. It's also a good idea to have a copy of your original tax return available.ĭownload a copy of IRS Form 1040X, Amended U.S. If you are claiming a new deduction or credit, any document that supports your eligibility to claim it such as a receipt will be helpful.

This includes any new 1098T,1099 or W-2 you receive if you under-reported your income. This will avoid any error from duplicate returns.įortunately, the IRS has a simple process in place that allows you to amend your tax return. I would wait until the original return is accepted by the IRS. If you have already filed your return then you will need to file an amended return.

There’s no need to call the IRS during that three-week period unless the tool specifically tells you to do so.If you have not filed your return than you can add this information by going to Education Credits and add the 1098-T form. It can take up to three weeks after filing it to show up in our system. As a reminder, amended returns take up to 16 weeks to process. The online tool includes an illustrated graphic that visually communicates where your amended return resides within the processing stages. Once authenticated, you can view the status of your amended return across three processing stages - Received, Adjusted, and Completed.

Turbotax 1040x amendment code#

When using either tool, you must enter your taxpayer identification number, such as your social security number, along with your date of birth, and ZIP code to prove your identity. Both tools are available in English and Spanish and track the status of amended returns for the current year and up to three prior years. Individual Income Tax Return using the Where's My Amended Return? online tool or by calling the toll-free telephone number 86 three weeks after you file your amended return. You can check the status of your Form 1040-X, Amended U.S. Please note: Due to COVID-19 processing delays, it’s taking us more than 20 weeks to process amended returns.

It depends on the type of mistake you made:

0 kommentar(er)

0 kommentar(er)